By now, just about everyone knows the boiling frog metaphor. The business parable now sits among the regal pantheon of Vince Lombardi quotes, TedTalks about body postures, and the mystical epiphanies which occur when you gaze deeply in your Steve Jobs mirror. So let’s take the boiling frog story and give it a new level of sophistication. We’ll call it the Big Lebowski moment. This moment occurs when you are chilling out in your bathtub, just like The Dude. Your candles softly glow, the water is nice and warm, and you probably just had some help to induce your tranquil state.

For real estate developers, this can be like the construction phase of the project. You’ve done the heavy lifting of designing the building and gaining approvals from the city. You’ve negotiated the contracts and obtained your financing. You sit back a little and marvel as your dream leaps off the paper (or digital file) and becomes reality. This building is really happening. Sure, you will worry about the rogue subcontractor, the deadlines that may ebb and flow, and the weather, but if you’ve set yourself up with a well-planned project you will enjoy the next 18 months.

Once construction winds down, the stress starts kicking in. Will my glorious creature be the pony that every child wants to ride or do I have an old nag who buries its nose in clover when a rider approaches? Or, even worse, did I open one of those dodgy carnivals in a parking lot of a vacant retail strip center and my ponies just got quarantined by the Douglas County Health Department? Rents get adjusted, special lease incentives are offered, sweat beads appear on your brow and the pulse quickens. In Big Lebowski terms, The Nihilists have just arrived while you’re sitting in the tub, and they’ve started to break your stuff in the living room.

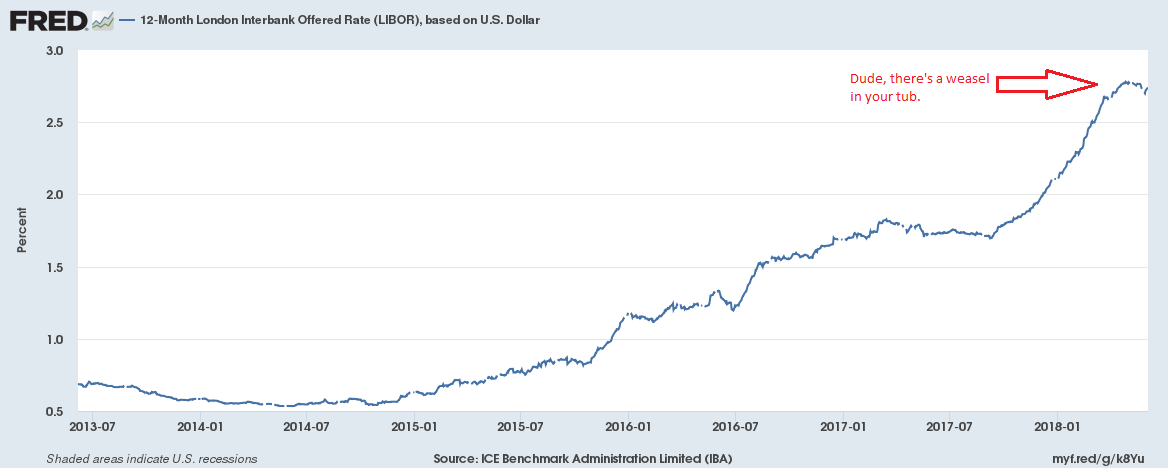

It gets worse. The Nihilists have brought a weasel with them (Hey, is that a marmot, man?). They throw the weasel in the bathtub. All hell breaks loose as the furry ferret turns into a screeching water snake keen on drawing blood from a sensitive region of the body. The tranquil tub becomes a frothing cauldron. For real estate developers, the angry weasel represents their debt. Real estate projects are highly dependent upon leverage. Most developers borrow 70% to 80% of their total project costs. Rising interest rates can threaten even the best developments.

Most construction loans have an interest-only period that terminate about 24 to 36 months after the start of construction. The end of the term is often referred to as the “conversion date”: the date at which the loan resets. On the conversion date, the interest rate adjusts to the current market level and the developer must begin paying some principal on the loan. For the past five years, rates have been in an innocuous range around 4%. Conversion dates came and went without much trepidation. Now, rates have risen dramatically. Many construction loans that were marked at LIBOR plus 3% two years ago will soon reset in a new and very weasel-ish world of 5% rates. One-year LIBOR sat at 1.73% in June of 2017, today it sits at 2.74%.

Well, that’s not so bad, you may say. After all it’s only 1% higher than it was a year ago. Yes, but the problem is exponential: your cost of money just went up by 20%. If you borrowed $10 million to build 100 apartments, you now face an additional $100,000 per year in interest expenses. On a per unit basis, that’s $83 per unit per month that you need to generate. From where I sit in Heartland, USA, $83 per month is a substantial amount of money. It’s probably a 10% increase on a one-bedroom apartment. My sister lives in San Francsco where they step over $100 dollar bills like soiled pennies, but here the number is the difference between two tanks of gas or an upper deck seat to see Kendrick Lamar. In other words, its a problem.

In a market facing over-supply, the pressure could become intense. Apartment construction has exceeded rates of household formation for the past six quarters. Higher interest rates will add to the challenges and pose a threat to developers in a way that has not been witnessed since 2007.

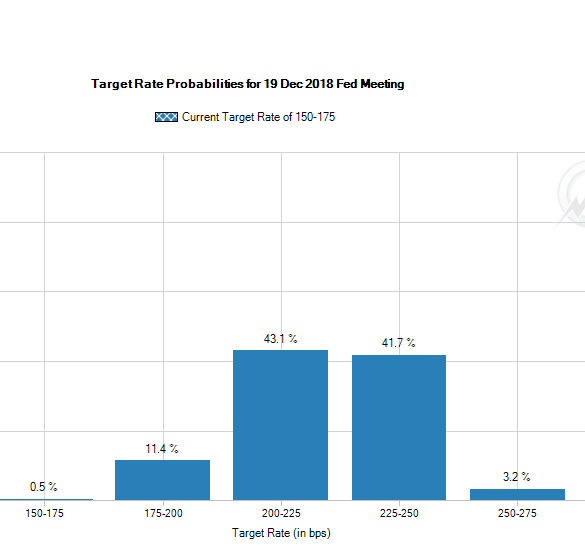

The interest rate environment places the Federal Reserve in a complicated position. The effective Federal Funds Rate is 1.75% and a 25 basis point increase is expected this week. Right now, markets place a probability of 41.7% on rates landing in the range of 2.25% to 2.5% by the December 2018 meeting.

There are three problems with this outlook:

- The 10 Year Treasury Yield stands at 2.96%. A surge in short term rates would almost certainly invert the yield curve – a signal that portends most recessions. The 5 Year Treasury is already at 2.80% which demonstrates a flattening yield curve.

- LIBOR rates track short term Fed Funds rates. Most short term financing is set on LIBOR plus a spread. If you extrapolate my example above regarding apartment rents to the entire economy, I do not believe that borrowers can cope with another 1% increase in the cost of short term funds.

- Increased rates will draw capital to the US and strengthen the US Dollar. The foreshadowing of this momentum has already set central banks into a frenzy of currency market intervention in Turkey, Brazil and Argentina. If the Mexican Peso joins the crowd, you could have a full blown currency crisis like 1994 or 1998.

The Mexican Peso (MXN) has fallen dramatically against the US Dollar (USD) since April. Source XE.com Currency Charts

Therefore, Jerome Powell must walk a tightrope. He must work to reduce inflation pressure and curb lending excesses, yet the risk of a recession rises with each quarter-point increase. He surely does not wish to create a lending crisis.

The intersection of interest rates, inflation and housing is even more complicated. Most measurements of the CPI show that housing costs are the major driver of inflation. I highly recommend reading the Bloomberg piece on the topic. There is some frustrating irony here: my industry, the one most susceptible to the risks of rising interest rates, is also the cause of the inflation which requires the Fed to raise rates. It’s a logical spiral that circles the drain like dirty water in a candlelit southern California bathtub.