Unlike most Hollywood scripts, media deals rarely live happily ever after. Disney is still healing from the acquisition of 20th Century Fox for $71 billion in 2019, which drew the ire of activist investor Nelson Peltz. The AOL-Time Warner merger of 2000 proved to be a fiasco. Even now, the heavy debt load carried by Warner Brothers Discovery is part of that legacy.

It came as quite a surprise to see Warner Brothers shares surge more than 33% last week as news spread of a pending bid from David Ellison’s Paramount Skydance. It has only been five weeks since the son of Larry Ellison muscled his way into ownership of Paramount for $8 billion. A deal for Warner Brothers would be larger by several orders of magnitude – in excess of $71 billion, including WBD’s onerous $35 billion of debt.

Contrast the swashbuckling exploits of Ellison with Brian Roberts, the second generation CEO of Comcast. Roberts transformed the cable company into a modern media giant by launching attacks during moments of industry distress. Comcast acquired AT&T’s broadband business in 2002 in the wake of the dot-com bubble, and preyed upon the ailing General Electric to buy NBC Universal in 2011.

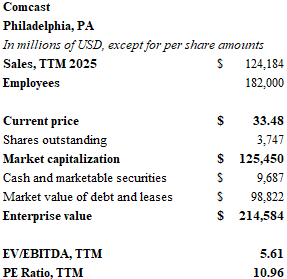

Comcast (CMCSA) stock presents an appealing investment opportunity. The share price has declined 46% since it peaked during the pandemic lockdown. Although the company faces growing competition from new fiber networks and fixed wireless providers, Comcast continues to increase revenues. In my estimation, Comcast trades at a 44% discount to the intrinsic value of its business.

Comcast, America’s largest broadband provider, generated over $124 billion in revenue over the past 12 months. The Philadelphia titan produced $12.5 billion in free cash flow in 2024.

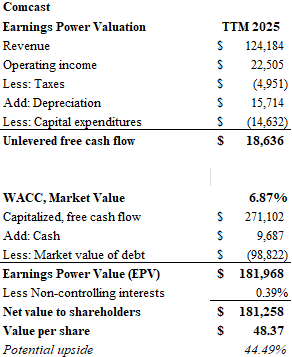

The following article offers a brief discussion of Comcast followed by a simple valuation presentation. I employ the earnings power value model (EPV) favored by Columbia’s Bruce Greenwald in the tradition of Graham and Dodd.

Comcast shares currently trade with a PE ratio of 11 and an attractive EV/EBITDA multiple of 5.6. The free cash flow yield exceeds 10%. While the equity price languished, over $13.5 billion of cash was returned to shareholders in 2024: $4.8 billion in dividends were awarded, and $8.6 billion of stock was repurchased. The current dividend yield is nearly 4%.

Comcast recently announced that it will spin-off some lower-tier networks to shareholders later this year. The new company will be known as Versant and will hold legacy networks such as CNBC, E!, USA and the Golf Channel. Various digital assets like Rotten Tomatoes will also be included. Notably, NBC and the Peacock streaming service will remain with Comcast.

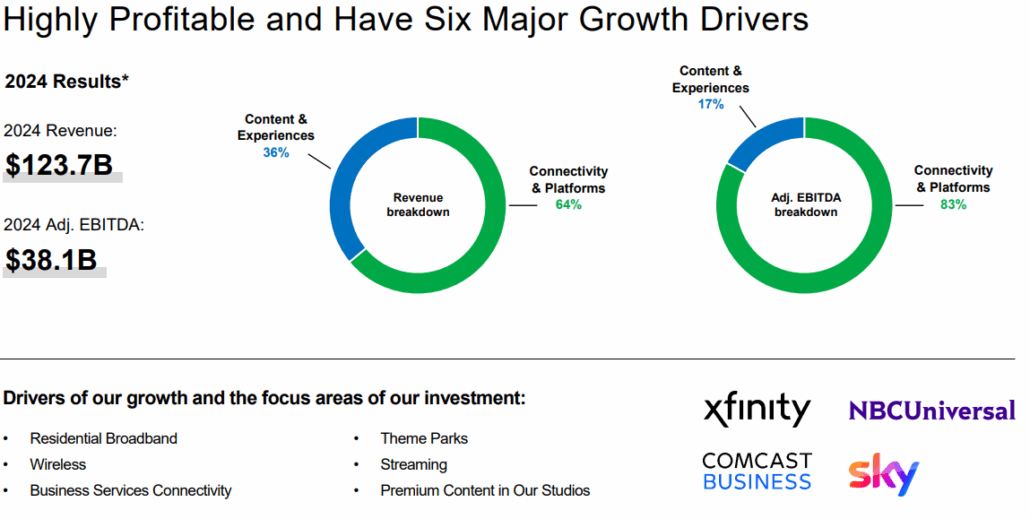

So why have Comcast shares performed so badly since 2021? Despite increasing revenues per user and a successful rollout of Xfinity mobile, Comcast has been losing customers in its legacy broadband and cable businesses. Although new lines of revenue are emerging, the content side of the business is much smaller. Unfortunately, it is also less profitable.

“Connectivity and platforms” accounted for 64% of Comcast’s $123.7 billion of 2024 revenue. These fixed-cost broadband and cable services offer tremendous operating leverage. EBITDA margins are 40%. Meanwhile the studio, network and theme park businesses have EBITDA margins of 20%. Reinvesting the cash from legacy broadband into media content is a fruitful exercise, but it can’t replicate near-monopoly profits the company once enjoyed.

Blockbuster movie releases like Jurassic World and Oppenheimer produce hundreds of millions in profits, not billions. New theme parks in Beijing and Japan are hitting their stride, but European expansion plans won’t move the needle much. The Peacock streaming service has yet to turn a profit, and Comcast recently bolstered the content of the streamer with an expensive NBA deal – a league suffering from declining viewership.

One can’t deny that a Paramount-Warner merger would represent a threat to Comcast. The venture could drive higher prices for content carried by Xfinity’s cable network, and a combination of two of the largest film studios might harness more resources into production. Ellison has already lured Jeff Shell, CEO of NBC Universal to Paramount.

The Roberts family controls Comcast through a solid lock on the company’s B shares. The lack of voting power in the A shares may be a further cause for a market discount.

Substantial growth will likely come from another transformative acquisition by Brian Roberts. The question is whether or not a bargain can be had. Will Comcast enter the fray and make a bid for Warner Brothers? It seems unlikely that Roberts would be interested in a bidding war.

And yet, the $71 billion enterprise value of WBD is roughly seven times EBITDA. Not cheap, but not unreasonable either. This multiple is slightly deceptive. Film and television content rights cost Warner Brothers more than $12 billion per year in working capital. Still, cash provided by operations was $5.4 billion in 2024 on $39.3 billion in revenues. All of the surplus funds went towards debt reduction.

William Cohan, the noted author and former Wall Street banker, has followed the Comcast story closely. Writes Cohan, “Though he was the son of Comcast architect Ralph Roberts, the entrepreneur who built the cable systems empire that mushroomed into the media behemoth, Brian rejected any sort of born-on-third base implications. He was immensely driven, aggressive, ambitious, and carnivorous.” While it may be nothing more than an anecdote, the word carnivorous is not usually associated with a patrician Philadelphia gentleman content with counting his stack of money. Growth is in his DNA. So is discipline.

Let’s turn to the value of the business.

The earnings power valuation (EPV) model results in an estimated price of $48 for Comcast’s shares. This represents potential upside of over 43% compared to its current $33.50 trading level.

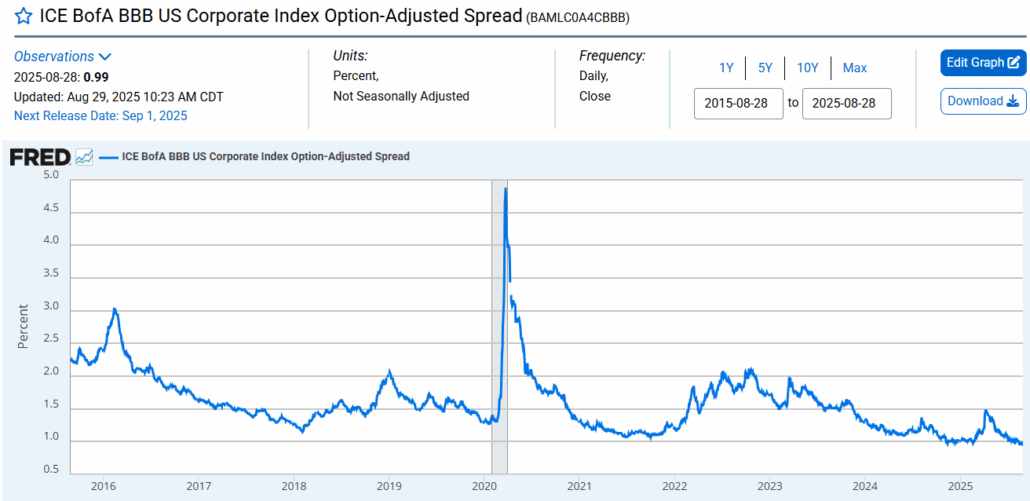

Comcast is rated A- by Standard & Poor’s. The company benefits from a well-managed debt profile amounting to $101.5 billion at the end of the June 2025 quarter. The weighted average interest rate on Comcast debt is 3.8% and the weighted average maturity is 15 years. Given that rates for similar quality obligations would be approximately 4.8% today, Comcast debt carries a market discount which puts it in the range of $98 billion.

The weighted average cost of capital for Comcast was calculated at 6.87%. This represents the aforementioned 4.8% debt cost (or about 3.7% after taxes) accounting for 41.5% of the company’s capital, and an equity cost imputed at 9.1%. The cost of equity is precisely imprecise. I don’t use beta, and I also don’t select an arbitrary “hurdle” rate. My cost of equity is a sum of the 10-Year Treasury Note at 4.03% plus a 0.75% debt spread for A- paper. Finally, I add an equity risk premium of 4.33%. The result is an equity cost of 9.1%, which seems reasonable given Comcast’s stable cash flow.

Operating income over the trailing twelve-month period amounted to $22.5 billion. Subtracting taxes of $5 billion, adding depreciation of $15.7 billion and subtracting capital expenditures of $14.6 billion, leads to unlevered free cash flow of $18.6 billion. Divide this number by the 6.87% WACC, and you have a capitalized gross value of $271.1 billion. Subtracting net debt of approximately $89 billion leads to a value for shareholders of $181.2 billion, or roughly $48 per share.

Patience will ultimately prove to be profitable for Comcast investors. While one waits for Roberts and his team to take advantage of turmoil in the Disney, Paramount and Warner Brothers universe, share repurchases and a hearty dividend make the waiting worthwhile.

Until next time.

DISCLAIMER

The information provided in this article is based on the opinions of the author after reviewing publicly available press reports and SEC filings. The author makes no representations or warranties as to accuracy of the content provided. This is not investment advice. You should perform your own due diligence before making any investments.