Jim Chanos, the famous Wall Street cynic, has cast a wary gaze upon real estate investment trusts that own large data centers. “This is our big short right now,” Chanos told the Financial Times. He has no doubts that cloud computing will continue to grow, but he believes that companies like Digital Realty Trust (DLR), Equinix (EQIX), and CyrusOne (CONE), are destined for trouble. His thesis: Amazon Web Services, Microsoft Azure, and Google Cloud will increasingly bypass the REITs to scale their operations by building data centers of their own. “The real problem for data center REITs is technical obsolescence,” said Chanos. “Their three biggest customers are becoming their biggest competitors. And when your biggest competitors are three of the most vicious competitors in the world then you have a problem.”

Chanos has a long record of success betting against overvalued businesses, but his assessment of the industry contrasts with Blackstone which recently purchased QTS Realty Trust for $10 billion. Meanwhile, Bill Stein, the CEO of Digital Realty Trust, quickly countered Chanos’ comments by pointing out his firm’s record bookings for the first two quarters of 2022. Yet the changing dynamics of the industry were on display Tuesday when FedEx announced that it will save $400 million annually by closing all of its data centers to move completely to the public cloud.

My rudimentary analysis of Data Realty Trust (DLR) indicates that the stock is overvalued by 10-15% relative to its underlying real estate. This kind of premium is uncomfortably high, but I’m not exactly grabbing my drumsticks for a round of Pantera. After all, the company has grown net operating income (or funds from operations, in REIT parlance) by 15% annually.

Despite the growth, there isn’t much appealing about a stock with a 3.8% dividend yield when you can earn 3% from 2-Year and 5-Year Treasury Notes. A business staring at such formidable competition should require a spread better than 80 basis points. A 25% drop in the price of the stock would be needed to produce a 5% yield.

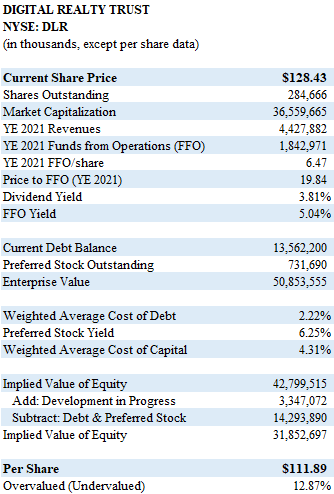

Statistics for Digital Realty Trust are presented below. The table demonstrates a valuation of its real estate assets by capitalizing 2021 funds from operations (FFO). I add development in progress at cost and subtract debt to arrive at a net asset value of $111.89 per share, which is about 13% below the price on July 7, 2022. One could argue that I should employ forward estimates of FFO for my computation, and this would be fair. However, I am using a very low capitalization rate of 4.31%. This reflects the company’s low borrowing costs (2.22%). The FFO yield was used as a proxy for the cost of equity.

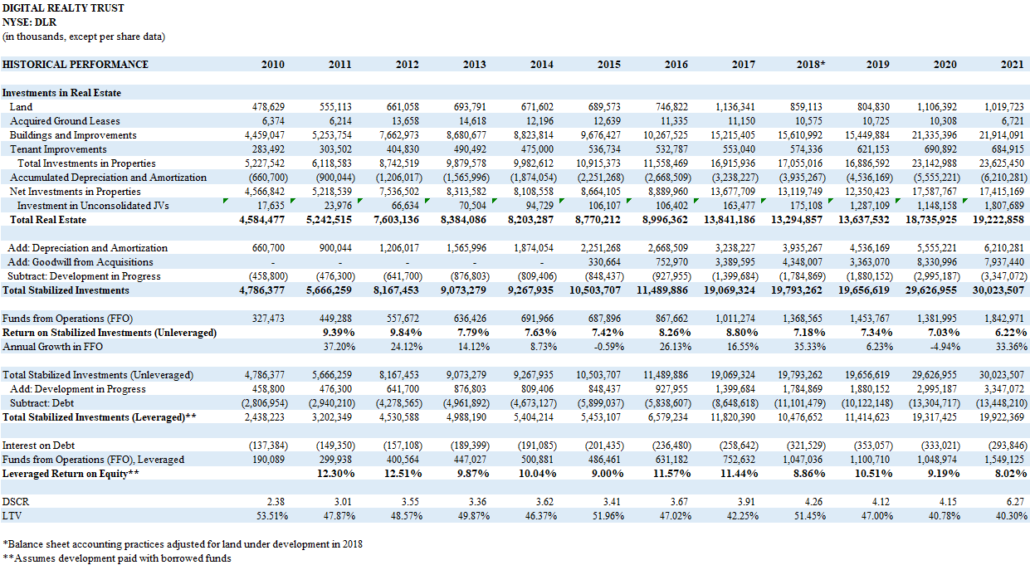

The second table shows results for the past 12 years. It indicates the rapid growth in net income for DLR, but it also shows that returns on total invested assets have been declining for years to levels below 7%. The low interest rate environment of the recent past juiced returns on equity, but even these results have become less impressive in recent periods. DLR has debt of about $13 billion on roughly $30-32 billion of assets, so the business is not exactly shy about using leverage. However, cheap debt acquired during the pandemic provided ample FFO debt coverage at 6.25x interest during 2021.

I don’t see a compelling reason to invest in DLR with the stock price trading above net asset values. And even though Jim Chanos may be hyperbolically talking his book, the threat posed by Amazon, Microsoft and Google is very real. Meanwhile, the dividends aren’t sufficient when the comparable safety of 3% Treasury yields beckons.

Note: This article contains the opinions and observations of the author. No investment recommendations are being provided and no representations are made to the accuracy of the content presented.

Bert Hancock, Author. July 7, 2022.