3rd Quarter Apartment REIT Review

“Grief is nature’s most powerful aphrodisiac” – Chazz Reinhold (Will Ferrell), Wedding Crashers (2005).

Back in 2005, I watched in disbelief while apartment leases were being broken left and right as residents began to purchase homes at a frenzied pace. While the economy boomed, the apartment industry suffered. Now, some have begun to whisper about the formation of a new bubble stimulated by the zero-rate environment established by the Federal Reserve to prop up an economy battered by the pandemic. In a surreal world where low wage service workers struggle to pay rent, more affluent renters have the sugar rush of cheap money to feed a new home-buying surge. Throw in a desire for more space to work from home and host dinner guests in the backyard, and buying a house… well, as Owen Wilson would say, “just, wow”.

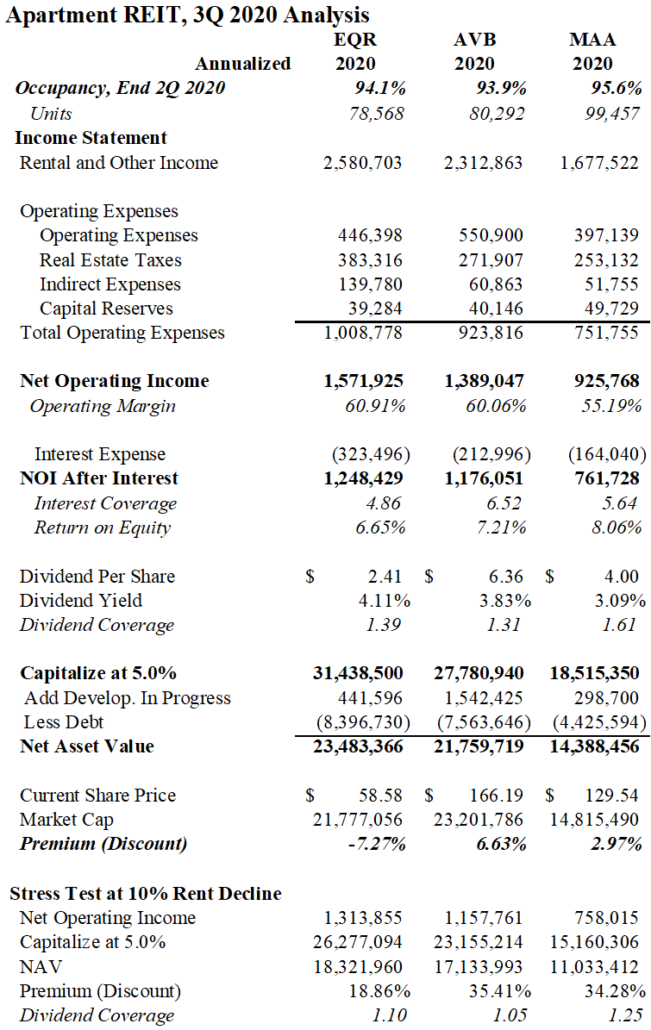

Back in August (which was eight months ago in pandemic time), I decided to look at quarterly results from publicly traded apartment owners to gain insights into where the market was heading. Third quarter results have been posted, so I revisited three of the biggest apartment real estate investment trusts: Equity Residential (EQR), AvalonBay (AVB) and Mid-America Apartment Communities (MAA).

The stocks have continued to trade at discounts to their March peaks and their dividend yields exceed 3%. The announcement of a vaccine breakthrough earlier this week sent the stock prices higher by 10%. The recent price increases have largely erased the deep discounts to net asset values, but they remain attractive as liquid income-producing investments. Their dividends are well-funded, leverage is manageable, and it is hard to envision further downside. EQR is the riskiest of the three because of the company’s high exposure to struggling urban markets, but MAA remains the star of the group due to its focus on sunbelt cities.

The attached article contains brief comments on the quarterly results, a numerical comparison of income and asset values as well as a back-of-the-envelope “stress test” to determine the safety of the dividend payments. Finally, I offer a few observations on the Omaha market where home purchases have caused increased turnover and vacancy.

Sunbelt Success Continues

Mid-America exhibits the divergence in the apartment industry: urban coastal cities are losing residents and many are relocating to dynamic growth centers in the south. As they had in August, executives exuded confidence in their quarterly call. Occupancy exceeded 96% and traffic was positive. Rent growth was muted due to increasing supply and competition from home purchases but remained positive. MAA is a standout performer because of its concentration in sunbelt cities throughout the southeast and Texas. The stock has nearly recovered its losses for the year.

Suburban vs. Urban

AvalonBay and Equity Residential noted positive leasing trends during October but reported that rent declines and move-outs exceeded expectations in urban markets, particularly Manhattan, Boston, and San Francisco. Rent declines surpassed 10% in big coastal cities. Occupancy dropped below 90% in central San Francisco – a stunning figure. Meanwhile suburban properties performed well. Overall occupancy at both firms was at the 94% level. At AvalonBay, rents declined 6% for the quarter on a year-over-year basis and 2% on a sequential quarterly basis. At EQR, rents declined 7.5% for the quarter on a year-over-year basis and 2.7% on a sequential quarterly basis. Collections remained strong – above 97%, but turnover increased. There were some glimmers of hope in the New York City core where major rent discounts and incentives have enticed bargain-hunters to seek upgrades within the market.

Similar Trends in Omaha

In large measure, the observations made by the leading apartment executives on their earnings calls mirror our experience in Omaha. Occupancy levels which had been above 95% for the past two years have fallen dramatically over the past 90 days – approaching 93% in many areas of the city. Effective occupancy may be even lower as one month of free rent has become a common incentive.

Home Purchases Pressure the Top End

The top end of the Omaha apartment market has been hammered by an acceleration of home-buying. Low interest rates are spurring a race to purchase houses despite rising costs amid a tight inventory and expensive lumber prices. There is a 2005-feel to the environment with a high number of lease-breaks. It has not reached a mania level, but loose credit has allowed buyers to emerge who probably wouldn’t have qualified for a mortgage at the beginning of the year. In certain submarkets, added new apartment supply is also depressing the leasing environment.

More Space

All three firms have noted an increase in demand for larger apartments as working from home seems to have spurred a choice for bigger apartments. Studios are difficult to rent across the country, and Omaha is no exception. EQR reported that many of their Manhattan buildings have experienced transfers to larger units within the same property.

Students and Lower-Income Challenges

EQR and AVB reported serious challenges in their Boston and Cambridge properties due to a lack of students in the area. Omaha is no different. Although UNO has strong enrollment figures, many have opted to remain at parents’ homes. International students are a major driver of central Omaha apartment demand, and they have not returned. Rent delinquencies had vanished over the summer, but have made a growing re-appearance as stimulus payments have been exhausted. Workers in the service sector are seeking assistance once again. Delinquencies are not catastrophic – probably running 1%-2% higher – but the trend is worrying.

Stress Test

Last quarter, I used a hypothetical 5% income decline to determine whether the firms could continue to fund their distributions. I increased the pressure to 10% this time around. The dividends appear safe but would certainly come close to being curtailed in such a scenario. It should be noted that the 10% reduction of rental income was taken from an annualized rental figure that already incorporates two quarters of rental declines. The annualized figures are simply the aggregation of results through September 30, 2020 plus an assumption that 4th quarter results will match those of the 3rd quarter.

Note: This article contains the opinions and observations of the author. No investment recommendations are being provided and no representations are made to the accuracy of the content provided.

Bert Hancock

November 12, 2020