The Road to Wellville

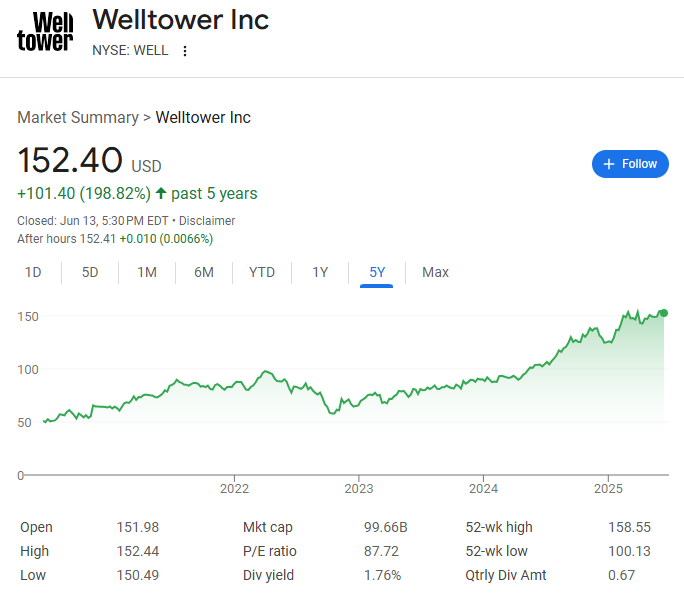

I keep a $5,000 short position in Welltower. It’s my hairshirt. I know it won’t change anything. My penance will not help mankind. I continue to view Welltower (WELL) as the most absurdly overvalued real estate investment trust in the market today. The company is a provider of senior living residential facilities. Welltower mesmerizes all who worhsip at the orthodox church of demographics. “Thou shalt not question thy trend of aging baby boomers” is the first commandment obeyed by all who kneel at the altar. Yet here I am. Tilting at windmills.

Welltower hovers near the $100 billion market capitalization level. No REIT can match Welltower for its voracious pace of expansion which exceeds double digit percentages on an annual basis. It has been an incredible growth story. But growth requires capital, and capital comes from the addition of new shares and debt. REITs, by their tax-advantaged status, must distribute most of their net income to shareholders. Retained earnings are usually a small source of investment capital.

Issuing new shares and debt for growth works just fine for as long as you can earn a return above the cost of capital. More shareholders aren’t a problem as long as the pie is bigger. Fail to do so, and the music eventually stops. REITs become dilution machines. Welltower is on the cusp of such an inflection. The company has raised nearly $21.5 billion in new shares since Covid. It has worked so far, but Welltower now struggles to cover its shareholder distributions. Will the market eventually figure it out?

Welltower’s real estate is valued by the market at an eye-watering implied capitalization rate of just over 2.5%. The FFO yield is 2.5%, and dividends yield a paltry 1.76%. In fairness, housing the elderly is more than just real estate. Services are a key part of the menu. But here’s where it gets worrisome: Welltower is unable to cover it’s current dividends with operating cash flow. By my estimation, about 25% of the company’s dividends to shareholders are funded through the issuance of new shares. The music is playing. The chairs are in a circle.

Just for fun, let’s look at BXP. One of the leading office landlords, BXP has seen its challenges since Covid. The stock trades with a $12.8 billion market cap and offers a 5.44% dividend yield. The implied cap rate for some of the nation’s premier office buildings is about 6.22%. This seems like a reasonable cap rate, until you start asking this question: “Who are the next buyers of these office buildings?” Pension funds probably aren’t lining up to acquire these assets. No more trophies. Class A in appearance, Class A in rentability, but probably not Class A in the transaction market.

Lest you be tempted by the 5% dividend yield, you should know that BXP also struggles to pay that dividend with cash flow.

So, it’s a quick look at a couple of REITs this week. It’s Father’s Day, so brevity is best.

Until next time.

Note: The estimate of maintenance capital expenditures for Welltower is based on 1.41% of depreciated assets in service. This is the average level of improvements as a percentage of total assets for the past six years. Also, some of you may think that I am unfairly punishing these two REITs by deducting capital expendiures from net operating income. I will say that my experience has been that you can’t have it both ways. You can’t add back depreciation AND exclude capital expenditures.

DISCLAIMER

The information provided in this article is based on the opinions of the author after reviewing publicly available press reports and SEC filings. The author makes no representations or warranties as to accuracy of the content provided. This is not investment advice. You should perform your own due diligence before making any investments.